In that case, individual transactions are recorded in subsidiary ledgers and the totals are transferred to an account in the general ledger. For large scale businesses where many transactions are conducted, it may not be convenient to enter all transactions in the general ledger due to the high volume. Cost of sales, marketing expenses, administration expenses Subsidiary LedgerĪ subsidiary ledger is a detailed sub set of accounts that contains transaction information. Share capital, share premium, retained earnings Incomeįunds received as a result of conducting business transactionsĮconomic costs that a business incurs through its operations to earn revenueĮ.g. Securities that represent the owners interest in the companyĮ.g. Loan repayment, interest payable, accounts payable Equity Long term and short term financial obligations that should be settledĮ.g. Property, cash and cash equivalents, accounts receivables Liabilities

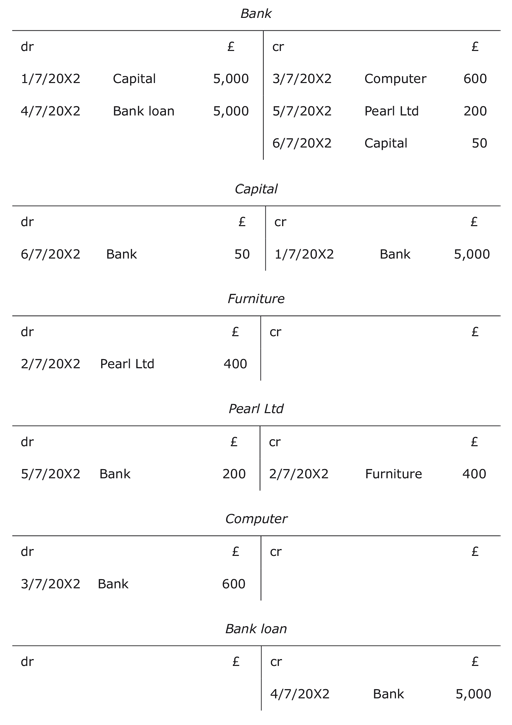

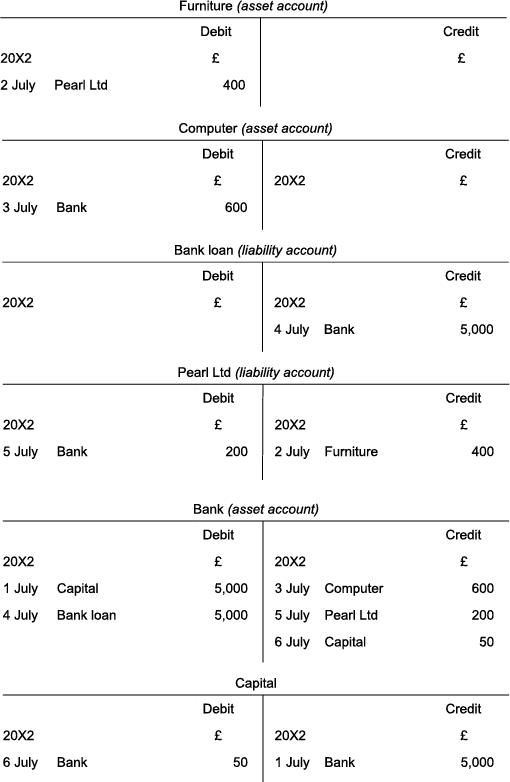

Long term and short term resources that provide economic benefitsĮ.g. There are five main types of classes or accounts as follows. General ledger contains all the debit and credit entries of transactions and is separated with classes of accounts. This is the principal set of accounts where all transactions conducted within the financial year are recorded. Read More: Difference Between Sales Ledger and Purchases Ledger General Ledger This ledger is crucial for companies that conduct manufacturing or trading operations. Purchases ledger reports all the funds paid on purchasing. Sales ledger is a very important ledger as it records the transactions of the core business activity. This is the ledger where all sales made to customers are recorded. Companies prepare different types of ledgers to record various transactions as follows. Ledger contains all the T accounts according to their class of accounts. However, the concept remains unchanged.Ī ledger is known as a collection of financial accounts. At present, accounting book keeping is largely done electronically, thus a column format is used instead of a T account. T accounts were used when accounting records were prepared manually. Thus the following entries will be entered into respective T accounts, i.e.

This results in an increase in inventory due to the new purchases and a reduction in cash due to the payment. purchases goods worth of $2,000 on cash from WOM Ltd. T accounts are prepared along with the ‘ double entry principle’ in accounting which states that every transaction results in equal and opposite effects in minimum two different accounts one as a debit entry and the other as a credit entry.Į.g. The total balance for each T account is shown at the bottom of the account. Debit entries are entered in the left side of the T and credits are entered to the right of the T. As the name suggests, it takes the shape of letter ‘T’, and the name of the account is placed above the T (sometimes along with the account number).

Side by Side Comparison – T Account vs LedgerĪ T account is a graphic representation of a ledger account.

#HOW TO DO A LEDGER T ACCOUNT SOFTWARE#

The introduction of new accounting software has made the preparation of T accounts and ledger more convenient and less time-consuming.Ĥ. Understanding T accounts and ledger is essential for obtaining a better knowledge regarding accounting book keeping process. Therefore, a ledger can also be interpreted as a collection of T accounts.

The key difference between T account and ledger is that T account is a graphical representation of a ledger account whereas ledger is a set financial accounts.

0 kommentar(er)

0 kommentar(er)